Programs - Cash Flow Management

Summary

The Programs - Cash Flow Management feature allows you to manage and capture periodic Cash Flow values that underpins each initiative project. It could be used for projects that have financial investments and impacts to adjust cash flows and monitor returns from time to time. Financial formulas typically used for corporate financial decision makings, such as NPV, IRR or Discounted Payback Period, will also be automatically calculated based on the Cash Flow inputs. The feature aims to provide real-time insights of projects' financial aspects to facilitate the evaluation of their financial feasibilities.

Main Features

Capture and update time based Cash Flow values per project

Customisable fields to be used in Cash Flow - choose your own fields in Programs Actions to be included in the Cash Flow

Flexible Cash Flow period - choose between by Year or by Month

Adjustable financial discount rate per project - a corporate wide default rate could also be established

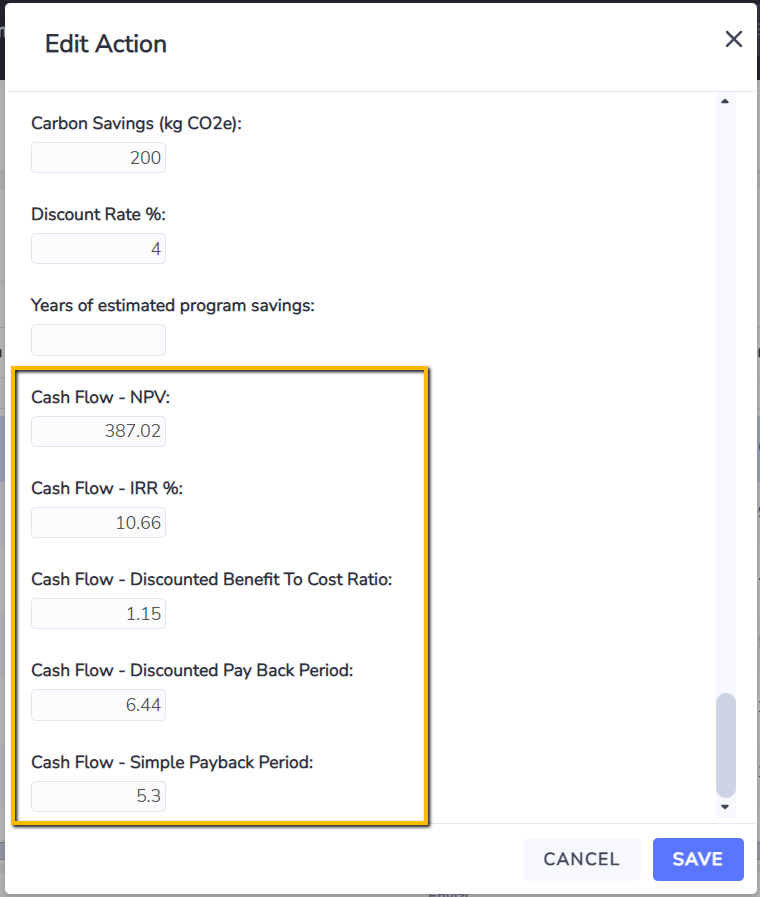

Automated financial formula calculations

NPV

IRR

Discounted Benefit-To-Cost Ratio

Discounted Pay Back Period

Simple Pay Back Period

Predefined projects saving period - from the project completion date to the end of project saving life cycle

Customisable financial formulas - we can tweak the formulas to match with your current financial practices

Customisable Programs Action fields calculation - total values of Cash Flow fields can be auto calculated and saved as field values in Programs Actions

Extendable financial formulas - we can work with you to define any bespoke financial formulas that are required and to include them in the module

How to access the feature

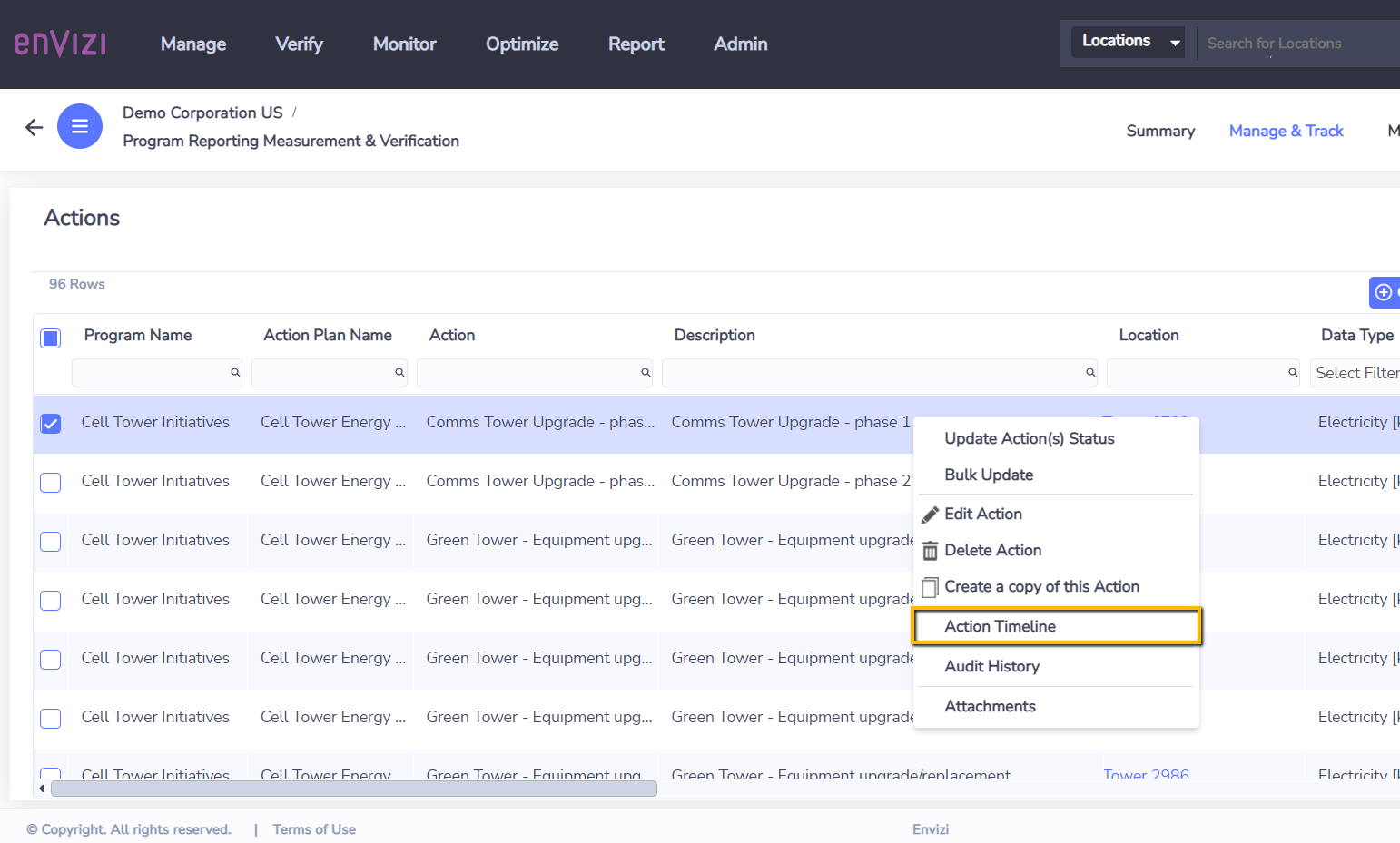

If the module is enabled, the Cash Flow feature can be accessed via the Actions grid → right click -> Action Timeline

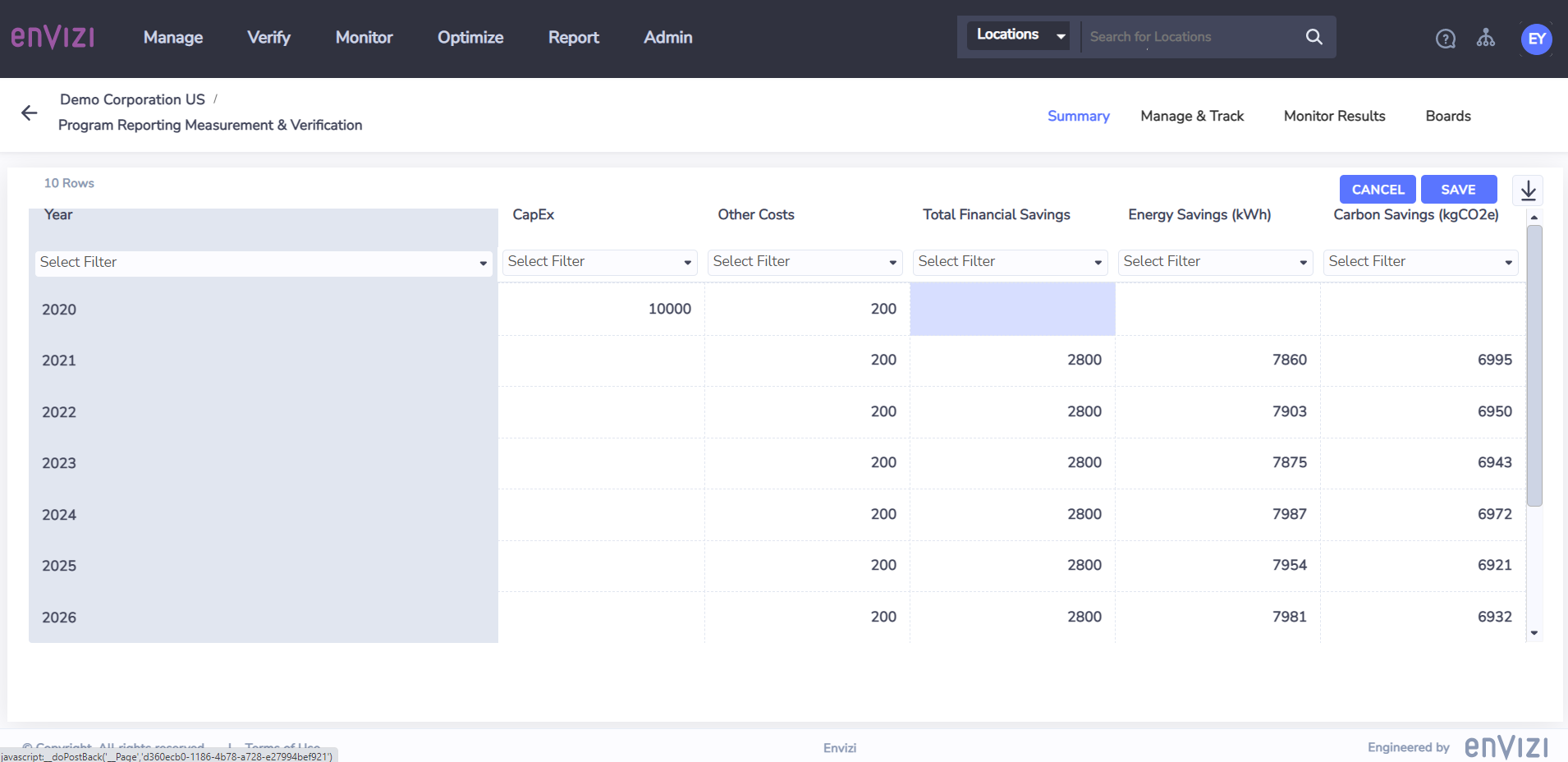

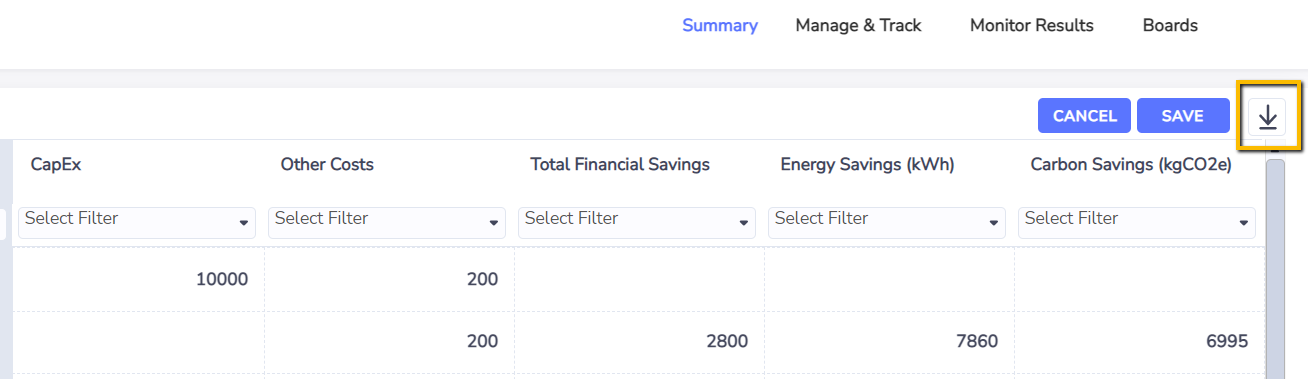

The Action Timeline grid page allows you to capture Cash Flow values by period. The list of Cash Flow fields should be customisable for your organization.

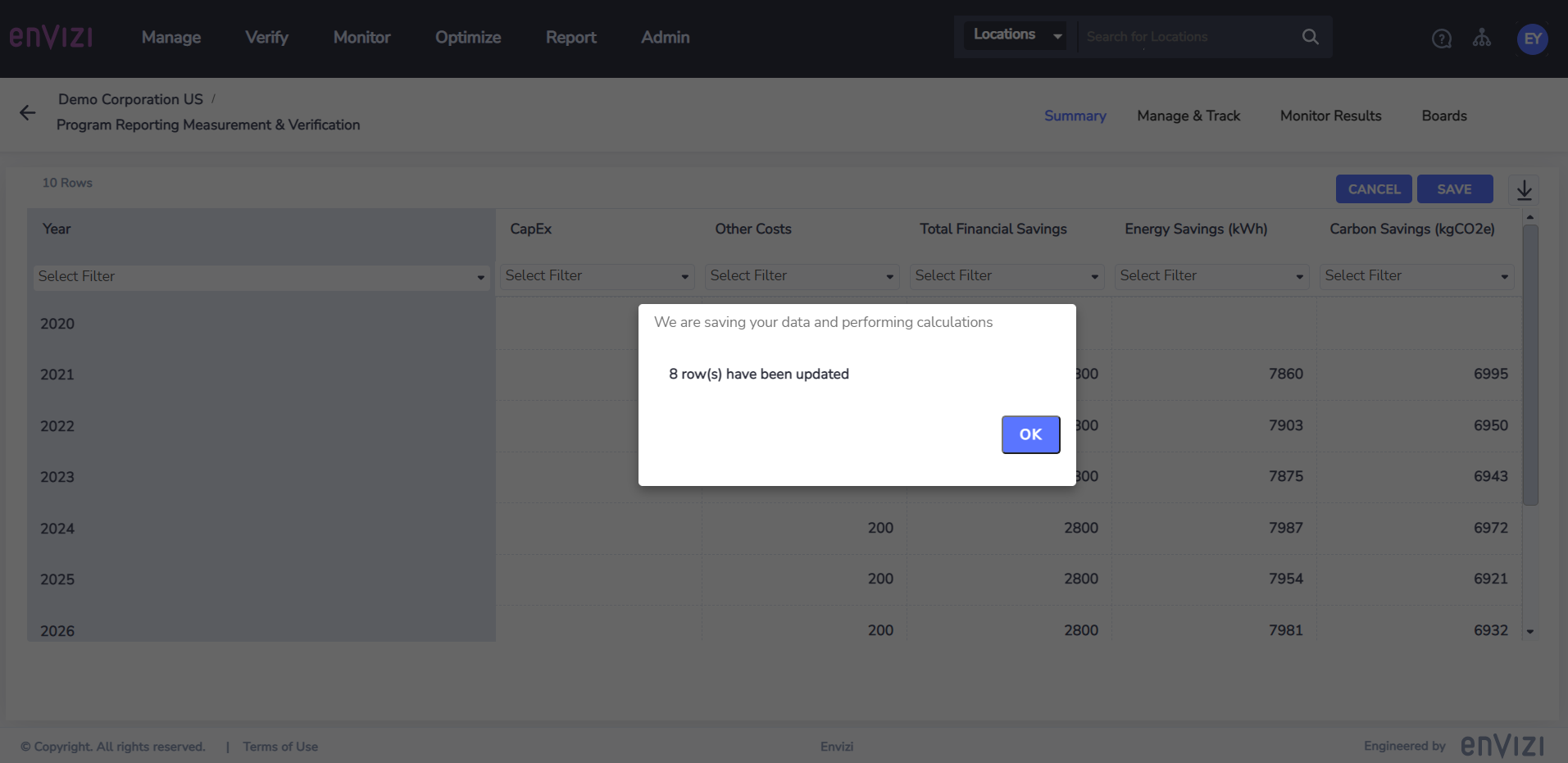

Once ‘Saved’, in addition to the time based Cash Flow values, the pre-defined financial formulas will also be automatically calculated and saved into Programs Actions fields of the project.

Module Set Up and Configuration

The Cash Flow feature is a ‘bespoke’ module so that it can be set up to match with your organization’s needs on cash flow management. In general the following should be considered for setting up the module:

What are the Programs Actions fields used to capture implementation costs

What are the Programs Actions fields used to capture financial savings

What is the corporate wide discount rate %, and whether it is adjustable per project

What are the required output financial formulas - e.g., NPV, IRR

What is the period for the Cash Flow - is it by year, or by month

When is the starting period for the Cash Flow - e.g., starting from when the project completes

When is the ending period for the Cash Flow - e.g., savings projection to end after 5 years of project completion

Once the above have been reviewed and assessed, please approach your corresponding Envizi contact or Envizi help desk for the enablement and setting up of the module.

Reporting

The Cash Flow values can be extracted via the grid extract button to CSV.

The Cash Flow values will also be included in the Power BI Monthly Data Set for Power BI Report users.

FAQ

How do I refresh the Cash Flow calculations after I have updated the discount rate % for my project ?

Please open the ‘Action Timeline’ and Save it again to trigger the re-calculation. This also applies even when none of the Cash Flow input values has changed.